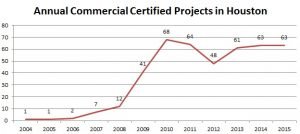

In the past two years, I’ve heard more and more questions about whether the local market is losing interest in the LEED Green Building Rating System. I’ve always quickly said no, but the frequency of the question got me to wondering if I was missing a bigger trend. Houston certifications have remained steady and the region has maintained its LEED rankings nationally for years. Houston has been #5 for LEED certified projects and #3 in certified area since at least 2012.

But the certification process takes years from the initial decision to pursue LEED. Project registrations are a more telling metric of current market attitudes so let’s take a look at those.

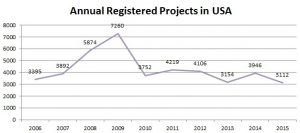

First, a look at the national trends. For the first years of LEED, new rating systems were introduced constantly. With each new rating system, a new occupancy type was able to join the LEED market. This resulted in an exponential growth curve that peaked in 2009 when the new LEED 2009 version became mandatory on June 27, 2009, resulting in a rush of registrations to lock projects into the easier LEED version 2.2. Then two occurrences coincided. First, the new rating system pipeline stopped. Secondly, the recession was having a significant impact on the building market by that time. After a large drop in 2010, national registrations leveled off and now generally reflect the ebbs and flows of the real estate market.

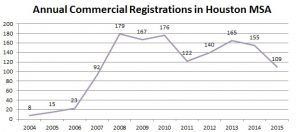

It was always assumed that projects certified under LEED for New Construction would transition to LEED for Existing Buildings (EBOM). LEED-EBOM even gives large advantages to buildings with NC certification. But, New Construction certifications are permanent and EBOM projects require renewal every five years and incredibly few NC projects continued with EBOM. When USGBC revealed its Dynamic Plaque in late 2014, they reported that only 55 of 23,000 certified LEED projects had transitioned to EBOM and only 300 projects of the 3,000 LEED-EBOM projects had recertified. (Article: leeduser) Late 2014 was early in the EBOM recertification history given the five year window, so many of those early EBOM certifications are just now coming due. The penalty for not renewing is loss of certification, but even that does not seem to be incentive enough. The lack of EBOM recertifications is evident in a number of cities dropping in the number of certifications in the most recent annual rankings. Houston has a much better percentage of recertifications than the reported 10% nationally. Since 2012, 64 of the 128 (50%) of EBOM registrations have been for recertifications in Houston. Still, local EBOM registrations are falling as new EBOM projects are not coming on board as often as before indicating a market saturation of owners willing and able to certify for EBOM.

As far as the annual number of projects registered locally, Houston weathered the recession better overall than the nation did and the energy boom is reflected in a peak of registrations in 2013. However, since 2013, the number of LEED registrations has been falling in Houston.

Is the local downward trend in registrations a rejection of LEED? One could also interpret this drop in registrations as aligning with the drop of the energy economy and the subsequent building contraction. This is especially evident in the local LEED-Core & Shell (CS) registrations. Locally, CS registrations were hit hard by the recession, rebounded quickly with the energy boom and have since been dropping along with price of oil.

We will most likely have another anomaly this year with an expected surge of registrations as the mandatory use of LEEDv4 goes into effect in October 2016.

2017 and beyond will be telling to see if registrations rebound with the real estate market as far as new construction registrations. There is also a huge potential market for EBOM projects in Houston, but the barriers to entry are high. LEEDv4 EBOM will require an Energy Star score of 75, meaning 75% of buildings are ineligible to participate in EBOM. LEED has made some movement toward programs based on performance improvements, but LEED stands for “Leadership” in building performance. Owners invest heavily in earning the certification. To avoid watering down LEED’s significance, another system needs to ultimately address the needs of the majority of existing buildings.

Another indication of untapped EBOM potential is that many non-LEED projects pursue Energy Star which is a declaration of performance. With 18 benchmarking and transparency laws in effect throughout the US currently, building performance is becoming more public than ever. This increased transparency may become an additional driver for LEED-EB pursuit.

So what is happening? Nothing unexpected. The same thing that happens with every adoption. It becomes normal. Media coverage has faded. Every new certification used to be mentioned in the Sunday Business section, but after long, there were so many certified buildings that no string of adjectives could get you to a coveted place of prominence. The CBRE National Green Building Adoption Index 2014 stated that “green-certified buildings now represent a major share of the US commercial office market, with the adoption of green space in some markets perhaps even approaching a saturation point.”

And that’s good. Market saturation was always where LEED strived to be. LEED has raised the bar, has raised expectations of how a building performs and responds to its occupants. USGBC long ago turned its attention and resources to overseas expansion of LEED. The low-hanging fruit has been gathered. USGBC’s domestic efforts have been in acquiring niche and stretch rating systems that will not have large market penetration in the near future. Growth is great, but LEED was always meant for the top performing properties, not for all properties. At this point, growth may no longer be about numbers, but rather about performance. LEED continues to evolve and become more stringent. Certification today is a much more substantial accomplishment than it was even five years ago. There may not be as many, but the plaque means more than ever.

All charts shown exclude LEED for Homes and LEED-ND projects.